[ad_1]

Consequently, the commissioner (appeals) upheld tax at 20% on interest income of about Rs 365 crore earned by it from Indian debt securities during FY19. As dividend income was exempt in the hands of shareholders, the dividend of nearly Rs 700 crore was not a subject of dispute.

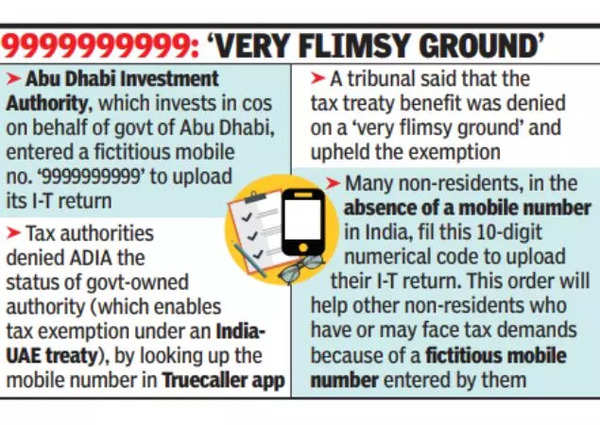

This led to ADIA filing an appeal with the Income Tax Appellate Tribunal. As a ‘govt’ body it was entitled to tax exemption in India, under Article 24 of the India-UAE tax treaty. ITAT frowned on the actions of the lower tax authorities and upheld the tax exemption.

Chartered accountants point out that a significant number of non-residents, in the absence of a mobile number in India, have filled in this 10-digit numerical code to upload their I-T return. This ITAT order will also help other non-residents who have or may face tax demands because of this fictitious mobile number entered by them.

In their order, the ITAT bench stressed that the tax treaty benefit had been denied on a ‘very flimsy ground’. The reason given by the commissioner (appeals) is that the mobile number ‘9999999999’ was indicated by the Truecaller app to be a fraud number. On this basis, the commissioner (appeals) surmised that ADIA is a fraud company, rather it concluded that it is not a company belonging to Abu Dhabi govt.

The ITAT bench pointed out, “Once all other details have been provided, and if that is doubted, then, he should have verified the PAN and the address provided in the return to see whether it is an Abu Dhabi govt-owned company. If he was incapable of verifying then, he should have asked the assessee (ADIA)… It is really surprising that the first appellate authority (aka appellate commissioner) will deny the status of govt-owned authority simply by looking up the mobile number in the Truecaller app. Such an approach is to be frowned upon and is liable to be rejected at the threshold.”

[ad_2]